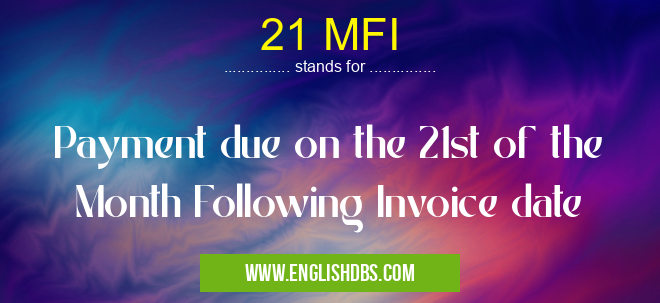

What does 21 MFI mean in ACCOUNTING

21 MFI stands for Payment due on the 21st of the Month Following Invoice date. It is an abbreviation used in business to refer to a payment arrangement in which payments must be made on the 21st day of the month following the invoice date. The purpose of this payment arrangement is to ensure timely payment and to help organizations manage their cash flow more effectively.

21 MFI meaning in Accounting in Business

21 MFI mostly used in an acronym Accounting in Category Business that means Payment due on the 21st of the Month Following Invoice date

Shorthand: 21 MFI,

Full Form: Payment due on the 21st of the Month Following Invoice date

For more information of "Payment due on the 21st of the Month Following Invoice date", see the section below.

» Business » Accounting

Explanation

The full form of 21 MFI means that payments are due on the 21st day after an invoice is issued. This payment arrangement helps businesses control their cash flow as they can easily track when customers pay them and can also plan for future operations more efficiently. This type of payment practice is common among businesses as it helps to ensure that bills are paid timely and keeps everyone involved accountable. Additionally, it holds both parties responsible for meeting deadlines and allows customers to spread out their payments over a longer period, reducing financial strain on either side.

Benefits

This payment arrangement has multiple benefits for both organizations and customers alike. For organizations, its main advantage is that it provides greater predictability around cash flow, allowing them to better forecast their expenses through planning ahead of time what their receivables will be each month. For customers, it allows them more flexibility in making payments as they are not required to make all payments at once but can instead spread out payments over several months. Additionally, customers have better control over budgeting since they know exactly when payments need to be made, which prevents any late fees or missed payments from occurring.

Essential Questions and Answers on Payment due on the 21st of the Month Following Invoice date in "BUSINESS»ACCOUNTING"

What does MFI stand for?

MFI stands for “Payment due on the 21st of the Month Following Invoice date.”

When is payment due with an MFI invoice?

Payment with an MFI invoice is due on the 21st day of the month following the invoice date.

Are there any exceptions to this policy?

Yes, there may be certain exceptions depending on the individual circumstances related to the invoice. It is important to check with your financial team or service provider for details specific to your payment requirements.

Does this rule apply to all invoices?

No, this rule only applies to those invoices which specify a payment due date as "MFI." All other invoices will follow separate payment terms and conditions.

Are payments accepted after their due date?

Yes, however late payments may be subject to penalty fees or interest charges if you exceed the predetermined time period associated with the MFI invoice. It is advised that you contact your financial team or service provider regarding such terms and conditions.

Is it possible to pay my invoice early?

Yes, you can make early payments unless otherwise specified by your financial team or service provider. Note that some penalty fees and interest charges may still be applicable when making early payments..

What happens when payment is not received within the designated timeframe?

If payment is not received within the designated timeframe, this may result in a penalty fee or interest charge. Contact your financial team or service provider for more information regarding such terms and conditions.

Can I use different methods of payment for my MFI invoice?

Generally speaking yes, you can usually choose from a variety of payment methods such as cash, check, credit card, wire transfer etc., however it’s best to check with your financial team or service provider first if they have any specific instructions or limitations related to these types of payments..

Final Words:

In conclusion, 21 MFI is a usefulpayment arrangement that is beneficial for both businesses and customers alike. By requiring bills to be paid within a certain timeframe, it helps manage cash flow while simultaneously providing flexibility for those paying invoices by allowing them time to make consistent payments without strain or worry about overdue charges or missed deadlines. Overall, this system offers many advantages that make managing finances easier for all involved parties.