What does #WORLDDOLLARS mean in COMPANIES & FIRMS

#WorldDollars is an informal term used to refer to the global trading of currencies, commodities, assets, and securities in a single pool. It has been popularized recently by the rise of the digital asset industry, but has been in practice for many years. #WorldDollars can also be viewed as a “global foreign exchange market” where buyers and sellers from all around the world can trade with one another and create their own personal portfolios. The types of assets traded include stocks, bonds, commodities, futures contracts, derivatives and cryptocurrencies. The number of #WorldDollar types can increase depending on the demand for new products or services within the global economy.

#WorldDollars meaning in Companies & Firms in Business

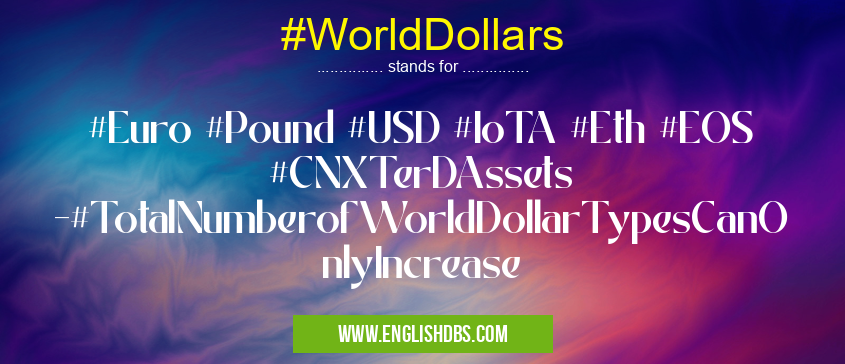

#WorldDollars mostly used in an acronym Companies & Firms in Category Business that means #Euro #Pound #USD #IoTA #Eth #EOS #CNXTerDAssets -#TotalNumberofWorldDollarTypesCanOnlyIncrease

Shorthand: #WorldDollars,

Full Form: #Euro #Pound #USD #IoTA #Eth #EOS #CNXTerDAssets -#TotalNumberofWorldDollarTypesCanOnlyIncrease

For more information of "#Euro #Pound #USD #IoTA #Eth #EOS #CNXTerDAssets -#TotalNumberofWorldDollarTypesCanOnlyIncrease", see the section below.

Meaning

#WorldDollars refers to a wide range of investments that can be bought and sold on different international markets at any given time. This includes domestic currencies such as dollars or euros along with commodities such as gold and silver as well as stocks, bonds, options and futures contracts. Cryptocurrencies like Bitcoin and Ethereum are also included in this mix making up part of what is considered #WorldDollar trading activity. Trading in these assets often requires more sophisticated knowledge than domestic-only investments due to factors such as currency fluctuations across different countries’ markets.

Full Form

No full form exists for #WorldDollars as it is an informal term used to describe global trading activities occurring outside traditional means or country boundaries when it comes to investing or financing operations in securities or other assets.

Essential Questions and Answers on #Euro #Pound #USD #IoTA #Eth #EOS #CNXTerDAssets -#TotalNumberofWorldDollarTypesCanOnlyIncrease in "BUSINESS»FIRMS"

How do I buy World Dollars?

World Dollars can be purchased with your existing fiat currency such as Euro, Pound, USD, IoTA, Eth, EOS, and CNXTerDAssets through an authorized exchange online.

What are the different types of World Dollar currencies?

Currently, there are seven types of World Dollar currencies - Euro, Pound, USD, IoTA, Eth, EOS and CNXTerDAssets. As more countries begin to adopt the use of digital currencies in their economy and the number of users increase globally, new types of digital coins may be added.

Is it safe to invest in World Dollars?

Investing in any type of financial instrument carries inherent risks. With that being said however investing in crypto-currencies like the ones that make up the World Dollar holds great potential for those willing to take on the risk. Before making any investment decisions always ensure you’ve done your due diligence and thoroughly understand what you are investing in.

What is a digital wallet and how can I get one for my World Dollar?

A digital wallet is a secure way to store your cryptocurrency. It is similar to a physical wallet but instead of storing paper money it holds public and private keys which are used to track ownership and manage transactions within a particular network or blockchain. In order to get a wallet for your World Dollar simply create an account with an authorized third-party provider that provides these services for your specific coin type (i.e., Ethereum).

Are there limits on how much money I can put into my World Dollar wallet?

Each wallet generally has its own limit depending on what platform you are using for storage so always check before sending funds over to ensure you don’t exceed any set limits imposed by different providers. Generally speaking however most wallets allow users to deposit up to $10k worth of any given coin type at a time without triggering additional regulations or requirements (e.g., KYC/AML).

Final Words:

In conclusion, #WorldDollars is an informal term used to refer to investment activities across national boundaries involving various assets such as stocks, bonds, commodities, futures contracts and cryptocurrencies among others. While there may not be a formal definition that applies universally across all investment scenarios involving multiple participants from different countries' markets at once; this term gives clarity regarding what activities may make up such investing practices that occur globally on an ever-increasing basis.